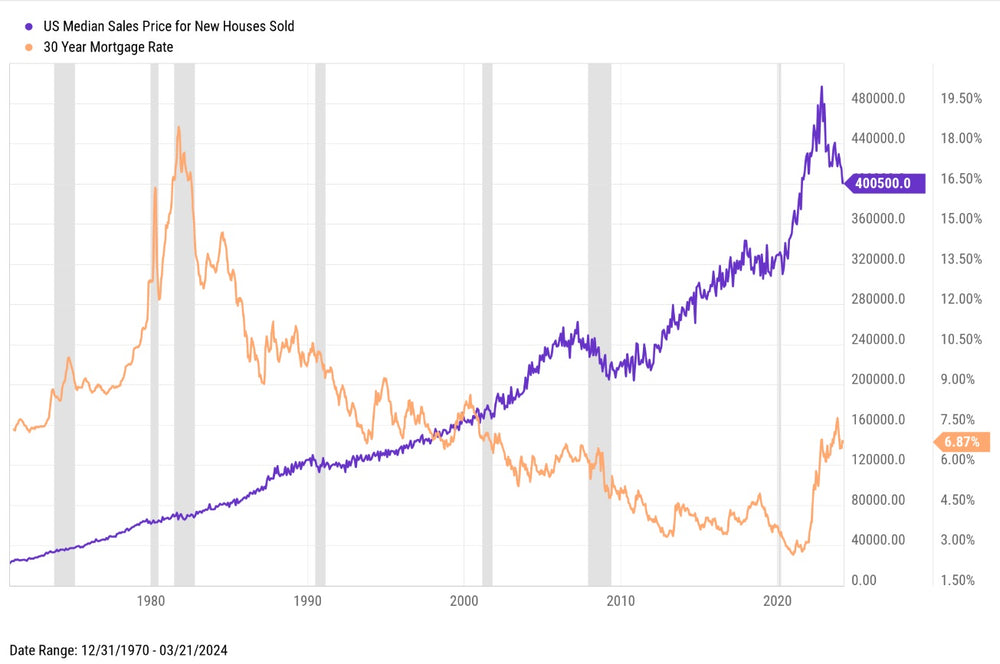

Investor Insight: Home Sales Price vs Interest Rate

Home prices have dropped about 20% since the peak in October of 2022. While this decline may sound like good news for home buyers, interest rates have soared, making those homes even more expensive. Historically it also signals a coming recession.

When analyzing the chart of US median home sales prices vs interest rates, not that rates rise first, home sales prices still move higher for another 6 months or so before starting to collapse. This lag can be seen historically in the data. It is likely the result of the fear of missing out trade, as buyers scramble to get in. However, in almost every single instance, the rise in interest rates eventually causes a dip in home sales price and also a recession.

Currently, the US has avoided a recession even with high interest rates and a decline in home prices. However, historically this is an anomaly. Probabilities likely signal a recession coming on the horizon.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.