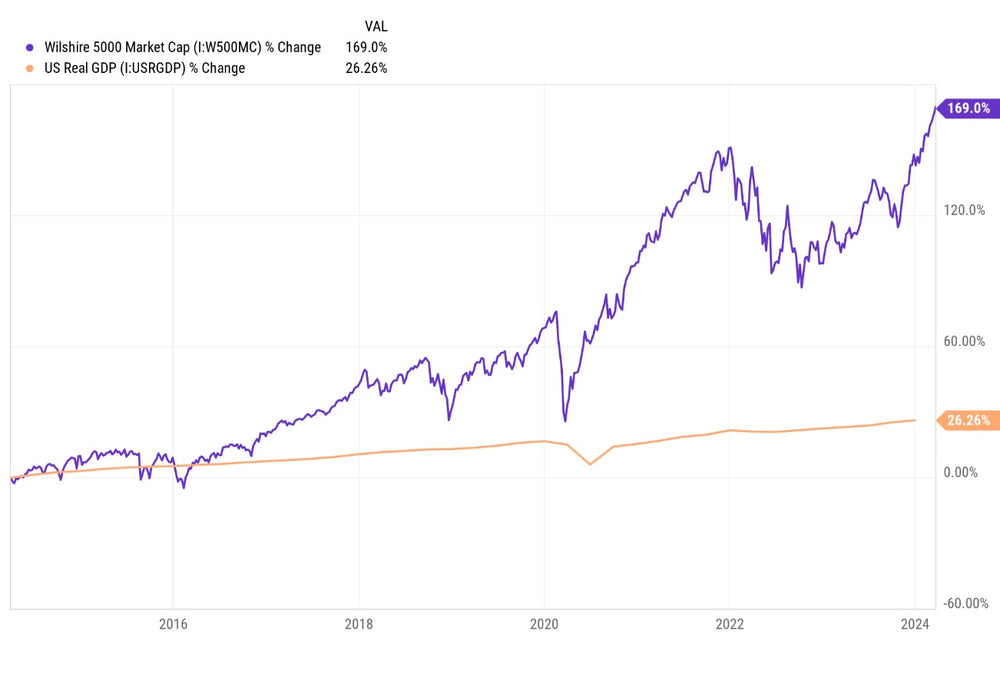

Market Cap To GDP Most Extended Ever

In just the last 10 years GDP has risen by 26.26% while market cap of the entire stock market has surged 169%. This is the biggest divergence between GDP and market cap ever seen in the United States. It likely spells trouble.

Historically, stock market valuation and GDP were closely tied today. However, ever since the Federal Reserve began printing money and the United States started to add trillions in debt per year, stocks have seen abnormal upside.

The idea here is that eventually market cap likely falls back to trend, somewhere around GDP. This would be a return to the historical norm. To make it simple, valuations in the stock market are way out of wack and could be setting up for a major decline in the coming years.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.