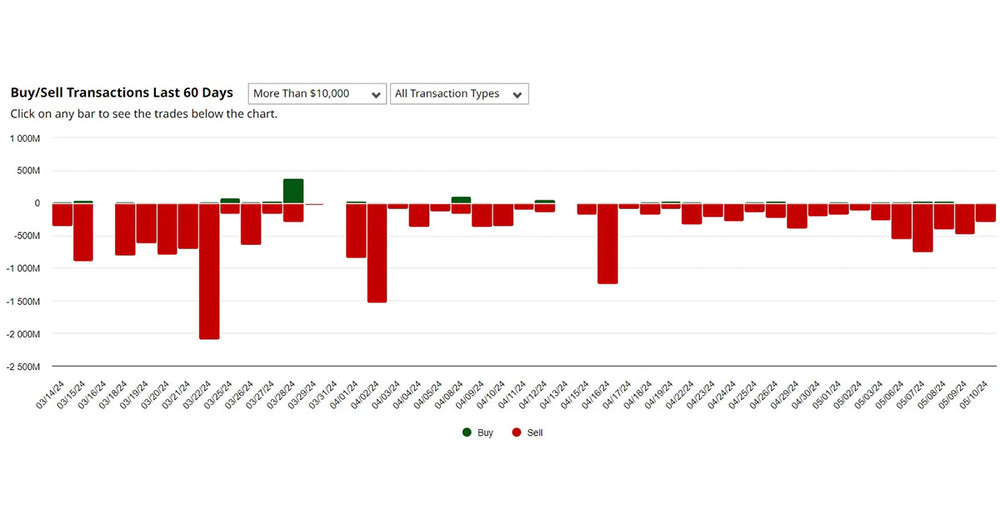

The Insider Trend: Buying And Selling Over The Last 60 Days

Insiders continue to dump stocks in the last 60 days. There has been almost no buying from CEO's, CFO's, COO's and other insiders in 2024. This warrants caution for investors as the last time insider selling was this heavy was just before the stock market top in late 2021.

When analyzing the chart of insider buying and selling over the last 60 days, investors can see that it has become lighter in recent weeks. However, that is a false flag because when companies report earnings there is a quiet period prior. The period right before earnings does not allow for insiders to sell or buy as it would look like they are trading directly on their earnings results.

As earnings have come to a close, in just the last week or two, it does appear selling is picking up again from insiders.

As a trader and investor, it is a good idea to see what the insiders are doing. While some selling is normal as insiders want to buy a house or boat, heavy selling is a warning sign historically for investors.

Remember, CEO's have the most information on the consumer in real time. If they are selling heavily, it usually signals trouble like in 2021. Always remember, a CEO or CFO is not going to be dumping stock if they truly think their stock is undervalued.

Verified Investing strives to help retail investors understand the data, charts and make informed decisions based on it. While most investors follow the hype on social media or the narrative the mainstream media is pushing, Verified Investing wants investors to get the REAL data and made a decision off of that. Verifed Investing is FOR investors.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.