The Stock Market Is Making It Impossitble For Inflation To Fall To 2%

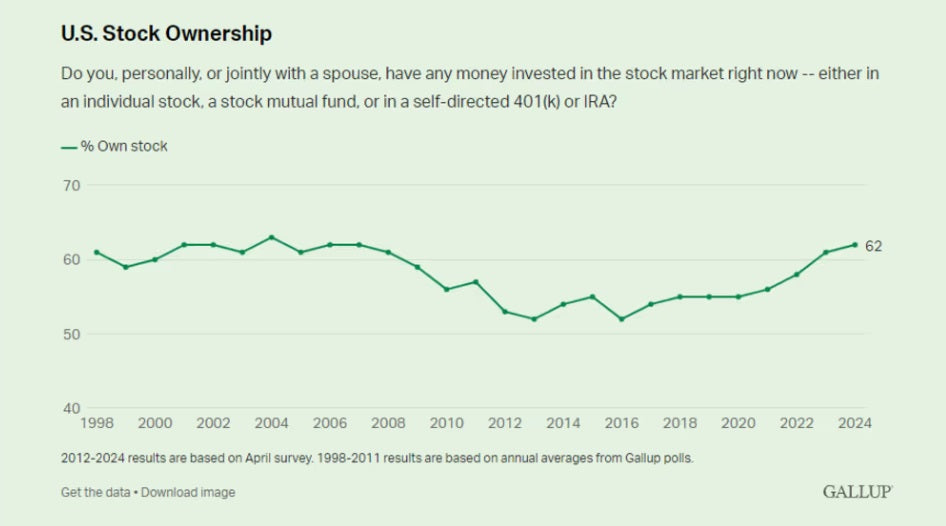

The Federal Reserve continues to stick by its 2% inflation goal. However, 2% will be impossible to achieve unless the consumer stops spending. With over 62% of Americans invested in the stock market, and the stock market hitting new-all time highs, the consumer has no need to cut back.

The 62% invested in the stock market continues to increase the divergence between rich and poor. The Federal Reserve's monetary policy has caused the stock market to go vertical over the last 15 years. Those invested become wealthy, those that are not get swallowed by the inevitable increase of inflation under this monetary policy.

There is a reason why the middle class is vanishing and society is fracturing. Federal Reserve monetary policy with government fiscal depravity is the culprit.

When looking at inflation, as long as the stock market stays at or pushes to new-all time highs, the 62% of Americans that have investments will keep spending like drunken sailors.

The Federal Reserve has to make a choice. Do they crush the economy and the stock market to bring inflation down to 2% or do they keep the good times rolling for the top tier of income earners while crushing the bottom under higher for longer inflation.

It does not take a genius to see how this does not end well. Be careful my friends.

Verified Investing is here to speak the truth and give the data. We fight for investors and citizens. Truth, data, facts and insights. Verified Investing tells the truth.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.