Understanding U.S. Debt-To-GDP And Why It Matters

The debt-to-GDP ratio in the United States is a critical economic indicator that measures the country's national debt relative to its economic output. It essentially expresses how many years it would take for the US to pay off its debt if it devoted its entire GDP to debt repayment.

Current Situation:

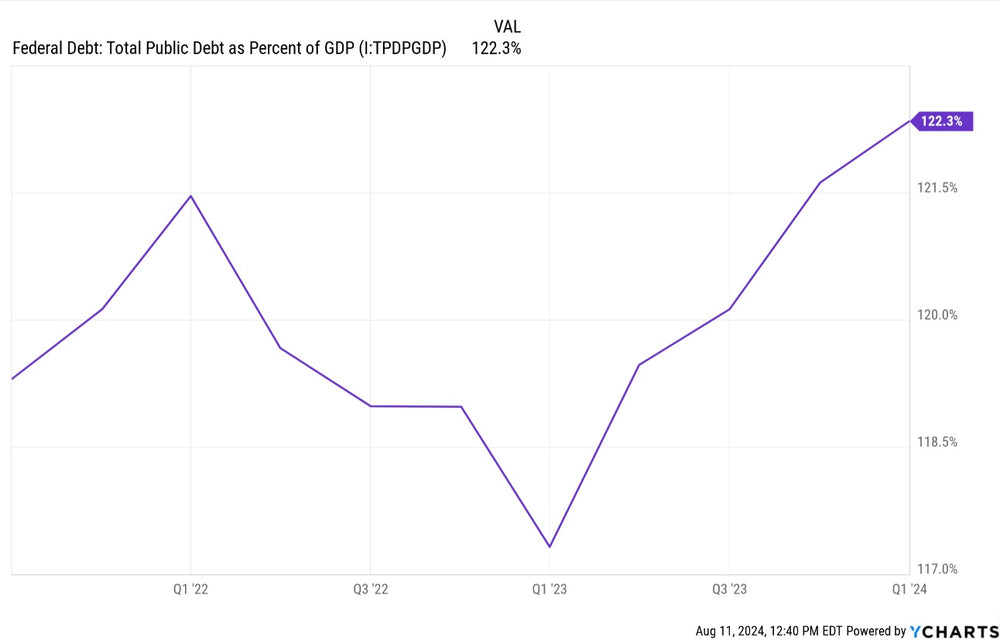

As of August 2024, the US debt-to-GDP ratio is over 120%. This means the national debt exceeds the country's annual economic output.

Implications:

- Sustainability of Borrowing: A high debt-to-GDP ratio may indicate potential difficulties for the government in servicing its debt, leading to higher interest rates or even a debt crisis.

- Economic Growth: High debt levels can crowd out private investment and reduce economic growth potential.

- Fiscal Flexibility: A large debt burden limits the government's ability to respond to economic downturns or other emergencies.

Important Considerations:

- Debt Composition: The US debt comprises debt held by the public and intragovernmental holdings. Debt held by the public is generally considered more relevant for assessing economic impact.

- Historical Context: The US debt-to-GDP ratio has been on an upward trajectory for decades, with significant increases during economic recessions and periods of increased government spending.

- Global Comparisons: The US debt-to-GDP ratio is high compared to historical norms but is in line with many other developed economies.

Conclusion:

The high US debt-to-GDP ratio poses challenges for policymakers, requiring careful management to ensure long-term economic stability and sustainability. While the current level may not be immediately alarming, it warrants ongoing attention and potential policy measures to address the rising debt burden.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.