Why Investors Should Be Watching The Yield Curve

The yield curve is a graph that plots the interest rates of bonds with the same credit quality but different maturities, typically U.S. Treasury bonds. It's important for a few key reasons:

1. Economic Forecasting:

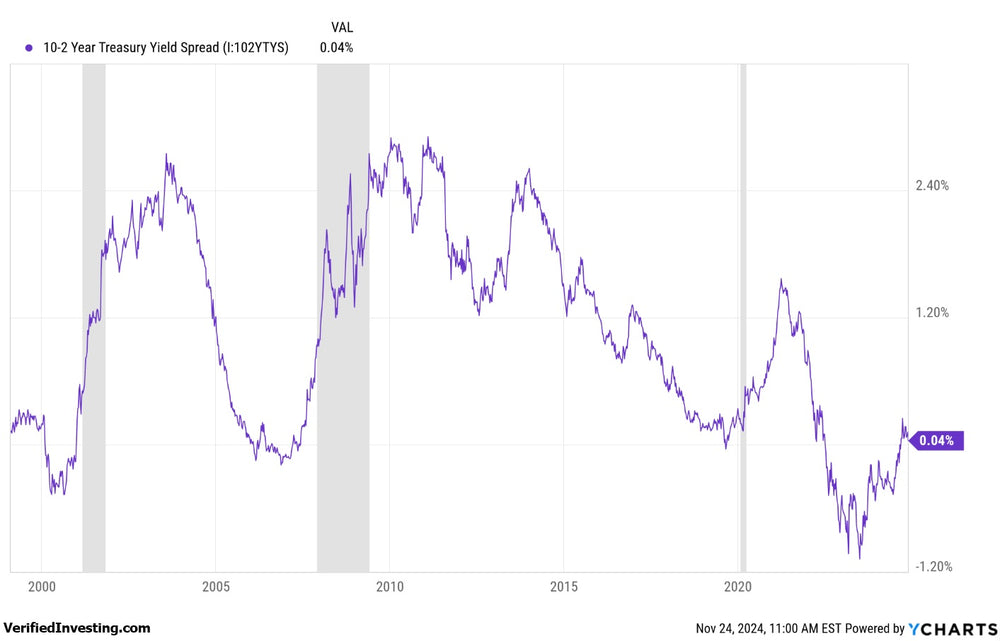

- Recession Indicator: The shape of the yield curve is often seen as a predictor of economic health. A normal, upward-sloping curve suggests that investors expect economic growth and higher inflation in the future. An inverted curve (where short-term rates are higher than long-term rates) has historically preceded recessions. This is because investors often demand higher yields for short-term bonds when they anticipate economic turmoil.

- Growth and Inflation Expectations: The slope of the yield curve reflects market expectations about future economic growth and inflation. A steep curve suggests strong growth and inflation expectations, while a flat or inverted curve indicates the opposite.

2. Monetary Policy:

- Central Bank Guidance: The yield curve is closely watched by central banks like the Federal Reserve. It provides insights into market expectations for future interest rate changes, which can influence their monetary policy decisions.

- Transmission Mechanism: Changes in the federal funds rate (the benchmark rate influenced by the Fed) ripple through the yield curve, affecting borrowing costs for businesses and consumers.

3. Investment Decisions:

- Bond Valuation: The yield curve helps investors understand how bond prices are likely to move in response to changes in interest rates.

- Asset Allocation: Investors use the yield curve to make informed decisions about allocating their assets between stocks and bonds. For example, an inverted yield curve may signal a shift towards more conservative investments.

- Profitability of Banks: Banks typically borrow money at short-term rates and lend at long-term rates. A steep yield curve is generally more profitable for banks, while an inverted curve can squeeze their margins.

In summary, the yield curve is a valuable tool for:

- Predicting economic conditions

- Guiding monetary policy

- Making informed investment decisions

It's important to remember that the yield curve is just one economic indicator, and it's not always a perfect predictor of future events. However, it provides valuable insights into market sentiment and expectations, making it an essential tool for economists, policymakers, and investors alike.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.