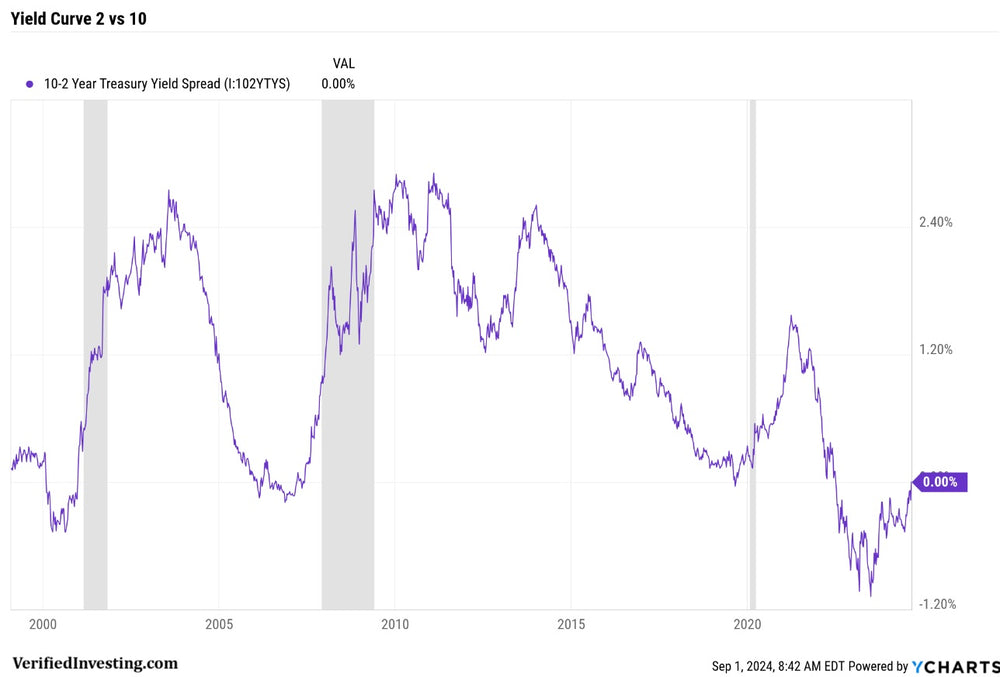

Yield Curve Flattens To 0, Historically, Next Is The Recession

The 2 and the 10 year yield have been inverted for the longest period in history. The yield curve has been inverted since July of 2022.

Historically, the inversion of the yield curve is the warning. The recession has always hit once the yield curve un-inverts. As of now, the yield curve has not un-inverted, but has gone back to the flat-line of 0.00%.

This is likely the period just before the un-inversion occurs. Once that happens, the clock begins ticking toward a recession.

Keep in mind, just like past recessions, the talking heads, economists and Federal Reserve are all predicting a soft landing or no landing at all. Yet the data clearly shows that is highly improbable. Noting the chart above, clearly shows that when the yield curve is inverted and un-inverts, a recession hits. Considering this inversion was the longest in history, it may even signal a much worse recession.

Data and charts speak truth. Economists, the Federal Reserve and talking heads speak a narrative based off hope and emotion. Verified Investing continues to use data to help investors find the most likely scenario, so they can avoid the hype of profit in the markets.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.