Concerning Facts: Federal Reserve Balance Sheet Analysis

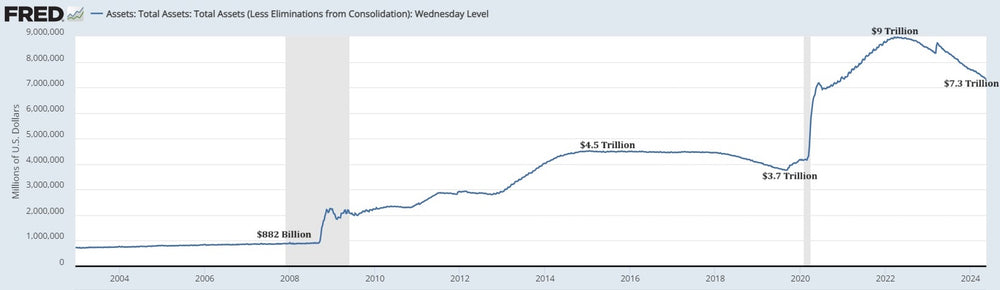

The U.S public debt sits at over $34.5 trillion. This is a whopping number by itself but Americans must also add the current balance sheet of the Federal Reserve which is $7.3 trillion. This puts the national debt at nearly $42 trillion and growing trillions a year.

The facts are scary when citizens realize that every crisis since 2008-9 has seen the balance sheet of the Federal Reserve surge. Following each crisis, instead of reducing the balance sheet fully, the Federal Reserve only reduces it by approximately 10-20% before the next crisis causes them to increase it by 100% or more.

Powell has recently announced that the Federal Reserve is winding down its balance sheet reduction from the previous covid surge. So once again, the runoff is almost complete with just a small drop overall from its highs.

Inevitably, there will be a new crisis and the Federal Reserve will take the balance sheet from over $7 trillion to $15 trillion. The U.S. debt is expanding at $1 trillion every three months during a solid economy. Any sort of recession will increase that 5x.

These are facts and the mismanagement of the U.S. debt and financial system is on a crash course. While it may take years to fully get into crisis mode, it is coming and investors and citizens need to be ready.

To protect yourself, diversify. Hard assets are key like gold, silver, platinum and palladium. While risky, Bitcoin may also be a potential safe haven.

Monetizing the debt is likely the only outcome. That means the Dollar will continue to lose value against hard assets.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.