Consumer Price Index (CPI) Data Analysis As Next Report Looms

Investors will be focused on the Consumer Price Index (CPI) data release on Wednesday June 12th at 8:30am ET.

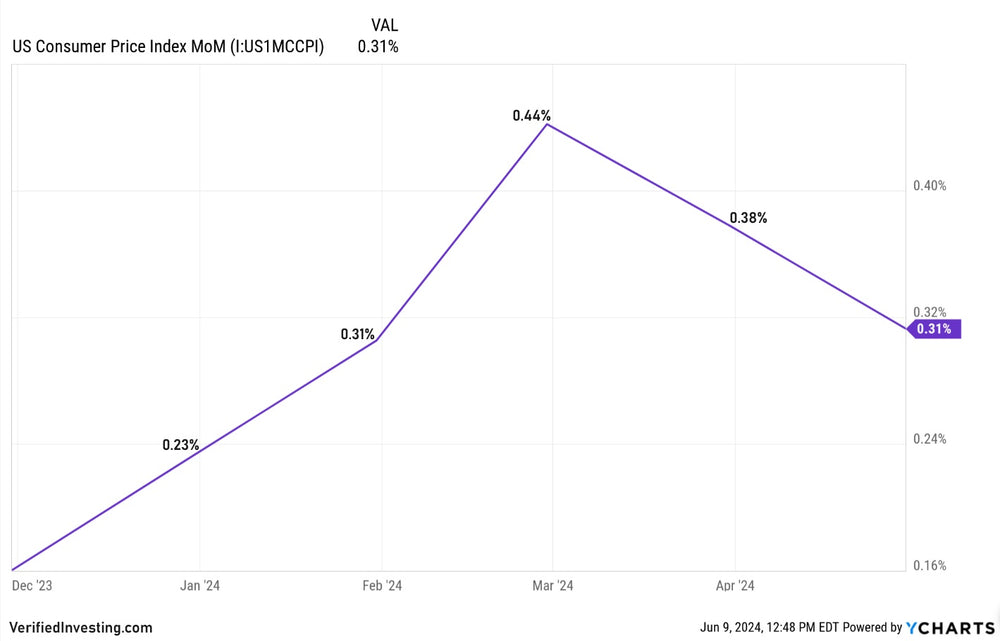

Expectations are for the May month over month CPI to be 0.3%, equal to last month's 0.3% month over month number.

In addition, the year over year CPI is expected to decline to 3.5% from last month's 3.6%.

Note, these numbers still put overall CPI far above the Federal Reserve's goal of 2% inflation.

The chart above shows CPI data over the last 8 months, highlighting that CPI was on the rise from December of 2023 through January 2024. While not back to its lows, CPI data has inched back down from its high of 0.44% in February 2024 to 0.31% in April 2024.

Commodities and labor costs have been a thorn in the of the Federal Reserve, along with rent, insurance and a few other select inflation measures.

Verified Investing prides itself on giving investors pure data driven analysis, no hype, no narratives. These are the numbers and facts. Investors get bombarded with so much nonsense from mainstream media to social media. Verified Investing is the one place investors can go for pure data driven insights and forecasts.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.