Core PCE (Inflation) Data Turns Up, Even Before Tariff Impact

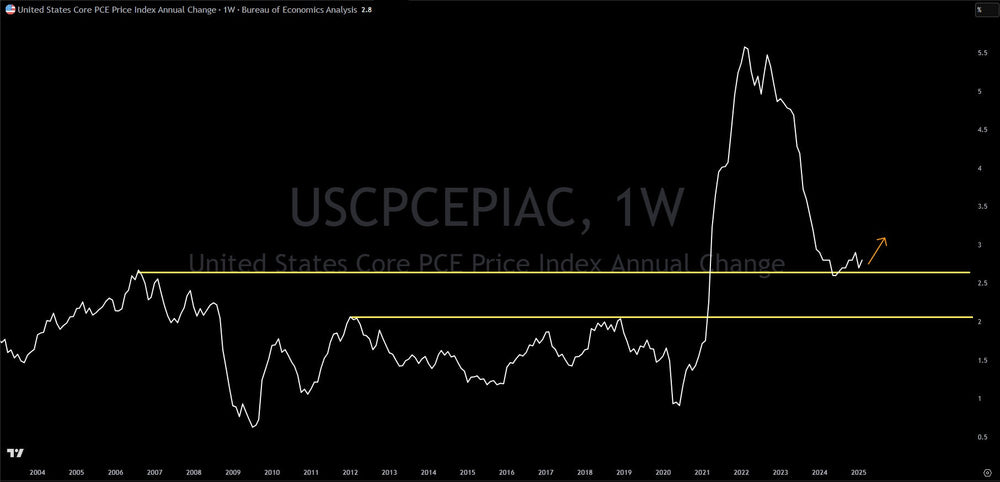

The Federal Reserve's closely watched inflation indicator, the core Personal Consumption Expenditures (PCE) Price Index, recently revealed a higher-than-anticipated increase in price pressures. For the reported period, core PCE rose to 2.8%, surpassing the consensus forecast of 2.7%.

Core PCE is a measure of inflation that excludes the volatile food and energy sectors, providing a clearer underlying trend in price changes. These excluded categories are often subject to significant fluctuations due to factors like weather, geopolitical events, and supply chain disruptions, which can obscure the broader inflation picture.

This unexpected uptick in core PCE suggests that inflationary pressures within the economy may be more persistent than previously anticipated. Investors reacted to this news with concern, as it implies that the Federal Reserve might need to maintain a tighter monetary policy for longer than expected, potentially leading to slower economic growth.

Adding to these concerns is the fact that this latest core PCE data does not yet reflect the impact of recently implemented tariffs by President Trump. These tariffs, which increase the cost of imported goods, are expected to further contribute to inflationary pressures as businesses pass on these higher costs to consumers. Items like automobiles, electronics, and various consumer goods could see price increases as the effects of the tariffs ripple through the economy.

In response to the hotter-than-expected inflation data and the looming impact of tariffs, the stock market experienced a significant sell-off. Investors are increasingly worried about a scenario where inflation continues to rise even as economic growth slows. This combination of stagnant economic growth and rising inflation is known as "stagflation," a challenging environment for both consumers and businesses.

Typically, inflation tends to rise when the economy is strong, characterized by robust demand and low unemployment. In such a scenario, consumers are generally better equipped to absorb higher prices due to increased wages and overall economic prosperity. However, when inflation rises during a period of economic slowdown, it creates a difficult situation. Consumers face higher costs for essential goods and services while potentially experiencing job insecurity or slower wage growth, making it harder to manage their finances.

Given the confluence of factors – elevated inflation, the anticipated impact of tariffs, and concerns about slowing economic growth – a cautious approach for investors in the near term appears prudent. Recent technical analysis indicates potential further downside in the stock market, with both the S&P 500 and the Nasdaq Composite having broken through key support levels. This suggests an increased probability of continued market weakness in the coming weeks and months as investors digest the implications of the current economic data and policy outlook.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.