Federal Reserve Balance Sheet: American Taxpayer Debt That Never Drops

The Federal Reserve keeps growing their balance sheet. Their balance sheet is code for additional debt to U.S. citizens. When the Federal Reserve started pushing up their balance sheet, they promised congress it would be short lived. Now 15 years later, it is still 1000% more than it was prior to the financial crisis. The Federal Reserve has signaled they no longer will run it down further.

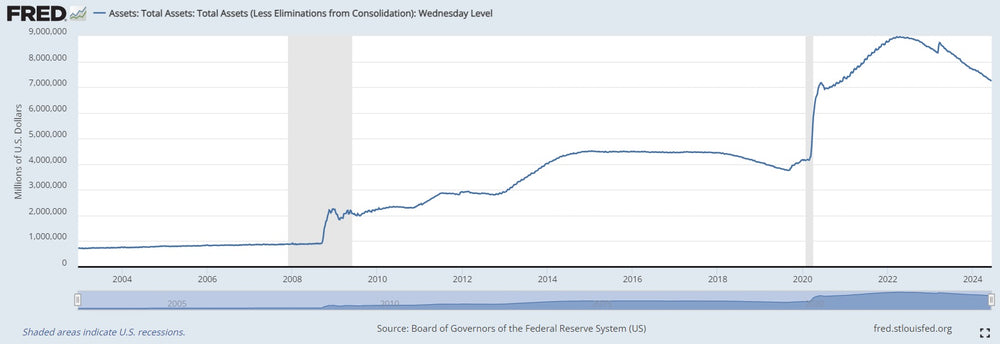

Every crisis that occurs, the Federal Reserve's balance sheet surges. Before the Great Recession in 2007, the Federal Reserve's balance sheet was below $1 trillion. During the Great Recession it grew over 150% to $2.2 trillion. Even during expansionary times that followed, the Federal Reserve kept growing their balance sheet as it moved up as high as $4.5 trillion. This was called QE (quantatative easing)

Then Covid hit. The Federal Reserve printed more money, jumping their balance sheet to over $9 trillion. Even with the incredible economy, the Federal Reserve has only brought their balance sheet down to $7 trillion. They are now stopping the reductions.

Every crisis, they run up their balance sheet. Every expansionary period after, they barely reduce it.

Every citizen needs to understand that the balance sheet is citizen debt. It is essentially the same as if the government was spending money and running up debt that taxpayers are on the hook for. This insanity only ends with a major financial reset.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.