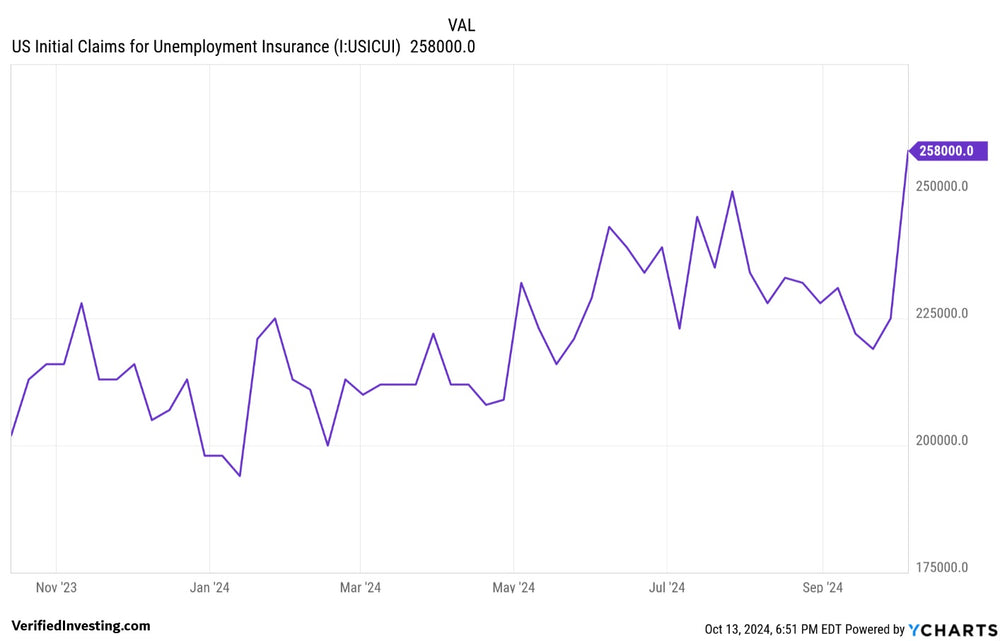

Initial Claims (Unemployment Filings) Trending Higher

Jobless Claims (Initial Claims for unemployment) spiked recently to 258,000. Investors need to be monitoring the 300,000 level. Should initial claims for unemployment get to 300,000, historically that has signaled a recession is on the verge.

In addition, jobless claims have been trending higher since January 2024. This implies a weakening labor market.

While the narrative has been a perfect landing by the Federal Reserve, there are too many unknowns to proclaim victory. An uptick in jobless claims is a worrying sign.

Jobless claims are a key economic indicator that reflects the number of people filing for unemployment benefits for the first time. Here's a breakdown:

What are jobless claims?

- Definition: The number of people who file applications for unemployment benefits with their state government. These individuals have become unemployed and are seeking financial assistance while looking for new work.

- Frequency: Reported weekly in the United States by the Department of Labor.

- Significance: They provide insights into the health of the labor market. A rise in jobless claims generally suggests that more people are losing their jobs, potentially indicating a weakening economy. Conversely, a decline in claims can signal a stronger job market.

Why are jobless claims important?

- Economic indicator: They are a leading indicator, meaning they tend to change before the economy as a whole shifts. This makes them valuable for economists and policymakers trying to understand where the economy is headed.

- Fed policy: The Federal Reserve (the central bank of the U.S.) considers jobless claims when making decisions about interest rates. High jobless claims might lead the Fed to lower interest rates to stimulate the economy, while low claims might encourage them to raise rates to combat inflation.

- Market sentiment: Investors closely watch jobless claims data. Unexpected changes can cause significant movements in the stock market.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.