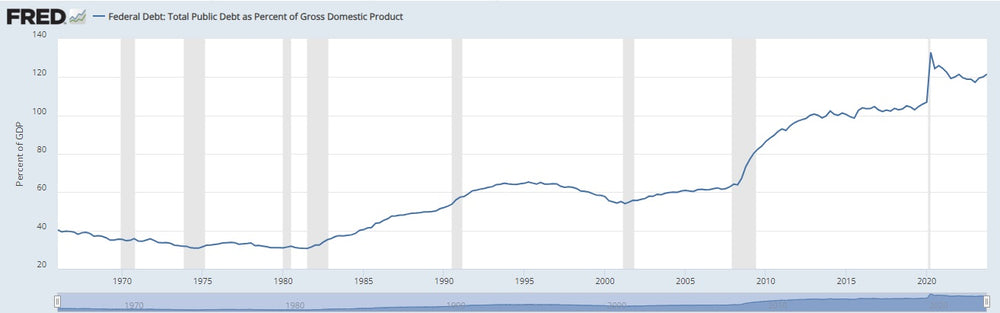

Monetary Policy And Gov Spending: United States Debt-To-GDP

U.S. debt-to-GDP has started to climb again, now hitting 121.62% as of the end of 2024. In reality, it is likely closer to 130% now as we are near the middle of 2024.

What investors and citizens should be shocked at, is that during expansionary periods, governments bring in more tax revenue and should be paying down the debt. During recessionary periods, governments spend more to stimulate growth and debt goes higher.

However, since 1980, debt-to-GDP has almost gone up without any declines. This is especially true from 2009 to current. This explains why the U.S. economy has had so few recessions and why they have been so short. The spending continues non-stop.

In addition, following 2009, the Federal Reserve has added $7.5 trillion to their balance sheet that acts the same as government spending.

This sets the U.S. economy on a path that will not end well. However, no investor knows exactly when the debt collapse will occur.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.