Payrolls Report Calms Nerves (For Now), Here Is The Data

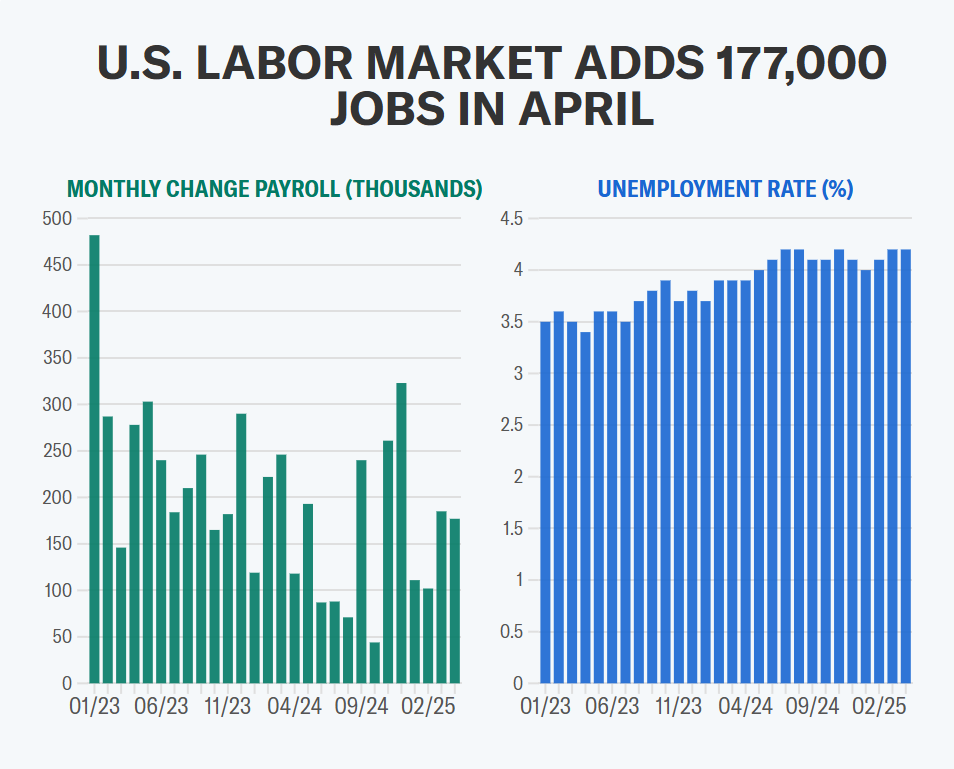

The U.S. labor market delivered a surprisingly robust performance in April, adding significantly more jobs than anticipated, while the unemployment rate held steady, according to data released Friday by the Bureau of Labor Statistics (BLS). However, the report also signaled a potential cooling in wage pressures, presenting a mixed picture for the economy.

Nonfarm payrolls increased by 177,000 in April, comfortably surpassing economists' forecasts of a 138,000 gain. This indicates continued resilience in hiring despite growing economic uncertainties, including concerns surrounding recent trade policies. Private sector employment drove the gains, adding 167,000 jobs, well above the 124,000 expected. Government payrolls saw a smaller increase of 10,000, although federal government employment actually declined by 9,000.

The unemployment rate remained unchanged at 4.2%, matching forecasts and staying within the narrow 4.0% to 4.2% range observed since May 2024. A broader measure of unemployment, the U6 rate, which includes discouraged workers and those working part-time for economic reasons, ticked down slightly to 7.8% from 7.9% in March, suggesting a marginal improvement in underemployment.

However, the report also included downward revisions to previous months' data. Job gains for February were revised down by 15,000 (to +102,000) and March figures were lowered by 43,000 (to +185,000), resulting in a combined 58,000 fewer jobs created over those two months than initially reported.

Wage Growth Slows, Easing Inflation Concerns?

While job creation remained strong, wage growth showed signs of moderation. Average hourly earnings rose 0.2% month-over-month, missing the forecast of 0.3%. On an annual basis, earnings increased by 3.8%, slightly below the 3.9% expectation and down from the 4.0% year-over-year rate seen in March.

This slowdown could be viewed positively by the Federal Reserve, as wage growth nearing the 3.5% mark is often considered consistent with the central bank's 2% inflation target. "Wage growth has been outpacing inflation for nearly two years," noted Jing Fu at Eye on Housing, though the April figures indicate this pressure might be easing. However, some analysts, like Teresa Ghilarducci at Forbes, suggest that despite nominal gains, modest real wage increases and a rise in long-term unemployment point to potentially weakening labor bargaining power.

Sector Performance and Economic Outlook

Job growth in April was led by familiar sectors. Healthcare added a strong 51,000 jobs, roughly in line with its recent average. Transportation and warehousing saw a significant jump of 29,000 jobs, potentially reflecting companies increasing inventories ahead of anticipated tariff impacts, as suggested by economists at CBS News and AP News. Financial activities also continued to trend upwards, adding 14,000 positions.

Despite the positive headline number, many economists caution that this report may not yet fully capture the potential economic drag from recent trade policy shifts and federal workforce reductions. "It's too early for tariffs to be impacting the job figures, which reflected the pay period including April 12," commented Preston Caldwell, senior US economist at Morningstar. Lydia Boussour, senior economist at EY, anticipates that "steep tariff increases and the surge in uncertainty... will result in a more pronounced labor market downshift." Daniel Zhao, Glassdoor's lead economist, referred to this report as "the benchmark against which we'll measure the tariff impacts."

Implications for the Federal Reserve

The combination of strong hiring and moderating wage growth likely reinforces the Federal Reserve's current "wait-and-see" approach. The solid job market gives the central bank "scope for patience" and reduces pressure for immediate interest rate cuts, according to Lindsay Rosner at Goldman Sachs Asset Management, as reported by Kiplinger. While rate cuts seem off the table for the Fed's May and June meetings, market watchers see increasing odds of a cut later in the year, potentially in July, should subsequent data show a more significant economic slowdown.

In conclusion, the April jobs report paints a picture of a labor market that remained surprisingly resilient, defying expectations of a sharper slowdown. However, cooling wage gains and significant downward revisions to prior months, coupled with looming uncertainty over trade policies and government spending cuts, suggest potential challenges ahead.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.