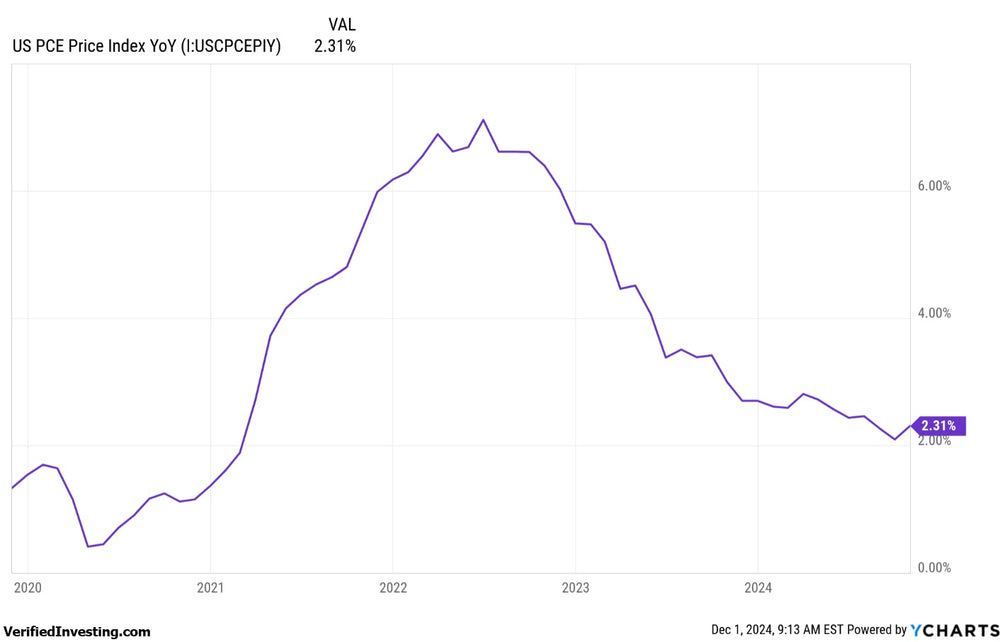

PCE Data Shows Inflation Getting Sticky Above 2% Fed Goal

The Federal Reserve's favorite gauge of inflation is showing an uptick, potentially signaling inflation will be sticky. This would make it tough for the Federal Reserve to cut rates aggressively if a recession hits the United States.

The latest reading for PCE (Personal Consumption Expenditures) came in at 2.3%. This was an increase from 2.1% the prior month.

The PCE Inflation Index, or Personal Consumption Expenditures Price Index, is a crucial measure of inflation in the United States. It tracks the changes in prices of goods and services purchased by consumers throughout the economy. Think of it as a way to measure how much more (or less) you're paying for things over time.

What it measures:

- Changes in consumer spending: The PCE tracks changes in the prices of a wide range of consumer goods and services, from groceries and gas to healthcare and haircuts.

- Actual consumer behavior: Unlike other inflation measures, the PCE accounts for changes in consumer behavior. For example, if the price of beef rises, people might buy more chicken instead. The PCE reflects this shift in spending habits.

Why it's important:

- The Fed's favorite: The Federal Reserve (the central bank of the U.S.) prefers the PCE over other inflation measures, like the Consumer Price Index (CPI), because it's more comprehensive and flexible.

- Monetary policy guide: The Fed uses the PCE to help decide whether to raise or lower interest rates. Their goal is to keep inflation at a healthy level (around 2%).

- Economic health indicator: The PCE provides valuable insights into the overall health of the economy and consumer spending trends.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.