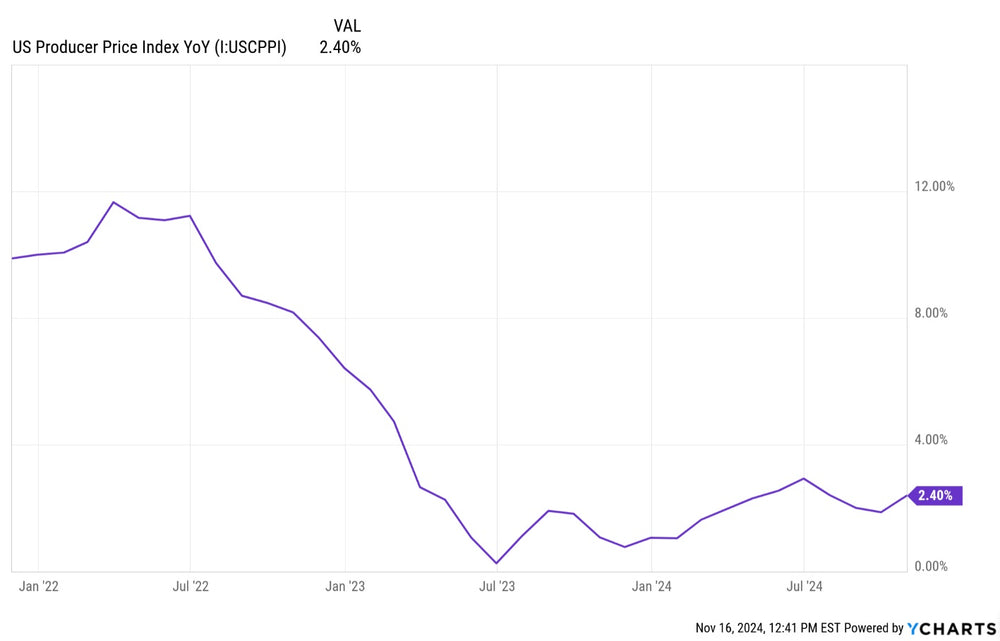

PPI (Producer Price Index) Year-Over-Year Continues To Creep Higher

The Producer Price Index (PPI) continued to inch higher in the latest reading, coming in at 2.4%. The major concern here is that inflation up-ticking on the producer side eventually gets pushed to the consumer side.

In addition, inflation is nowhere near the 2% level the Federal Reserve wants, and it is already starting to inch higher.

This has far reaching implications for how much interest rates can drop going forward. With the 10 year yield already spiking to 4.50%, investors are beginning to get nervous.

Let's take a more in-depth look at what it is and means...

The Producer Price Index (PPI) measures the average change over time in selling prices received by domestic producers for their output. Essentially, it tracks wholesale prices. A rising PPI can have significant implications for inflation and the overall economy:

Implications for Inflation:

- Leading Indicator: PPI is often seen as a leading indicator of consumer inflation (CPI). Increases in producer prices often get passed along to consumers as businesses try to maintain their profit margins. This means rising PPI can signal future increases in the cost of living.

- Early Warning System: Monitoring PPI gives policymakers and businesses an early warning of potential inflationary pressures. This allows them to take measures to mitigate the impact of rising prices.

- Supply Chain Disruptions: A rising PPI can reflect supply chain bottlenecks, shortages of raw materials, or increased production costs. These factors can contribute to inflationary pressures by driving up the cost of goods.

Implications for the Economy:

- Business Costs: Rising input costs for businesses can squeeze profit margins, potentially leading to reduced investment, hiring freezes, or even layoffs.

- Consumer Spending: As inflation rises due to increased producer prices, consumers may cut back on spending as their purchasing power erodes. This can slow economic growth.

- Interest Rates: A rising PPI can put pressure on central banks (like the Federal Reserve) to raise interest rates to curb inflation. Higher interest rates can make borrowing more expensive, potentially slowing down investment and economic activity.

- Wage-Price Spiral: If businesses pass on higher costs to consumers, and those consumers demand higher wages to keep up with the rising cost of living, it can lead to a wage-price spiral where inflation becomes entrenched.

However, it's important to consider these nuances:

- Not Always Predictive: While PPI can be a good predictor of CPI, the relationship isn't perfect. Other factors like consumer demand, competition, and retailer pricing strategies also influence consumer prices.

- Sectoral Differences: PPI can vary significantly across different sectors of the economy. A rise in PPI in one sector (e.g., energy) might have a larger impact on overall inflation than a rise in another sector (e.g., textiles).

- Base Effects: PPI data can be influenced by "base effects," where year-over-year comparisons can be skewed by unusually high or low prices in the previous year.

In conclusion:

A rising PPI is a signal that inflationary pressures are building in the economy. It warrants close monitoring by policymakers and businesses. While it often precedes consumer price increases, it's crucial to consider other economic indicators and factors to get a complete picture of the inflationary environment and its potential impact on the economy.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.