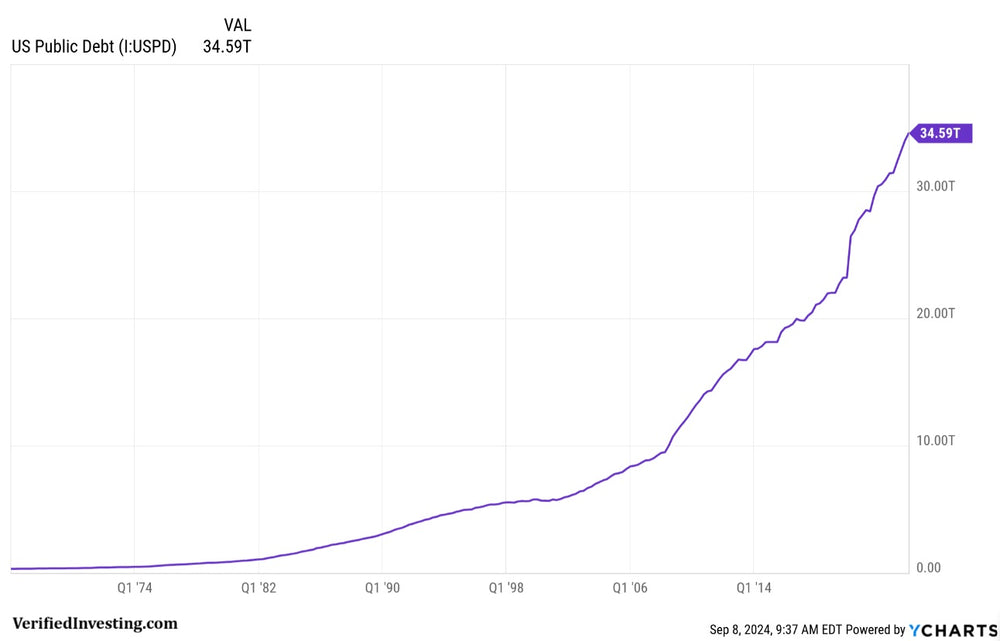

The Rising Risks Of Ever Rising U.S. Debt

The U.S. national debt is now above $35 trillion and rising quickly. The scariest thing about the rising public debt is that governments are supposed to take on debt during recessions but then pay it down during expansions. The U.S. has been in a solid expansion (aside from quick recessions) since 2009, yet the national debt has continued to rise non-stop. As the U.S. moves toward recession, this means even more debt may have to be taken on and if not, a prolonged recession may be in the cards. Below are some keys to understanding the implications.

If the US debt continues to rise, there are several potential implications:

Economic implications:

- Higher interest payments: As the debt grows, the government must pay more in interest, leaving less money for other programs or requiring higher taxes.

- Crowding out private investment: High levels of government borrowing can increase interest rates, making it more expensive for businesses and individuals to borrow and invest.

- Inflation risk: If the government resorts to printing money to pay its debts, it could lead to inflation, reducing the value of the dollar.

- Slower economic growth: Higher debt levels can lead to slower economic growth due to the factors mentioned above.

- Potential fiscal crisis: If investors lose confidence in the US government's ability to manage its debt, it could trigger a fiscal crisis, leading to higher interest rates, a falling dollar, and economic instability.

Social and political implications:

- Reduced government services: High debt levels can lead to cuts in government programs and services, impacting areas like education, healthcare, and infrastructure.

- Increased taxes: To address rising debt, the government may need to increase taxes, which can be unpopular and affect economic growth.

- Intergenerational inequity: Future generations may be burdened with higher taxes and reduced economic opportunities due to the debt accumulated by previous generations.

- Political instability: Debt can become a contentious political issue, leading to gridlock and difficulty in addressing other pressing challenges.

International implications:

- Weakened US dollar: High debt levels can erode confidence in the US dollar, potentially leading to a decline in its value relative to other currencies.

- Reduced US influence: A weaker economy and fiscal instability can reduce US influence on the global stage.

- Increased reliance on foreign creditors: As the debt grows, the US may become more reliant on foreign creditors, which could have geopolitical implications

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.