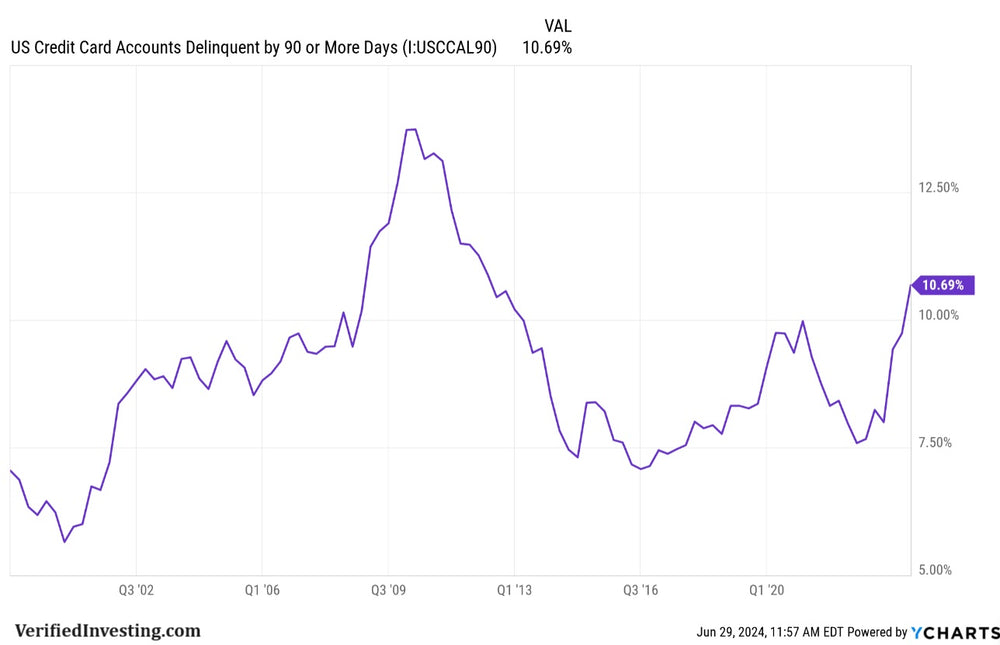

Credit Card Delinquency Rate (90 Days Or More)

As the labor market quickly cools, investors should pay attention to the credit card delinquency rate. The credit card delinquency rate of 90 days or more has spiked to 10.93%. The only and only time it was higher was during the 2008-2010 Great Recession period.

This spike in delinquency rates speaks to inflation and the growing number of Americans struggling in the economy. Delinquency rates also show a consumer that continues to spend, while having little to no ability to pay the debts they are running up. This will eventually hit the balance sheets of companies like Visa, Mastercard, Discover and even American Express.

Eventually, credit card usage gets shut down by the credit card companies and consumer spending will take another leg lower. In addition, high deliquency rates show an economy that is hanging on by a thread and likely headed toward recession.

It can be argued that the stock market has kept the high end consumers spending while the low end (without investments) has already been swept into a depression. If the stock market begins to fall and does not recover like it has in the past, the recession that hits the U.S. could be prolonged.

Follow these quarterly delinquency reports for a good understanding of the current economic situation.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.